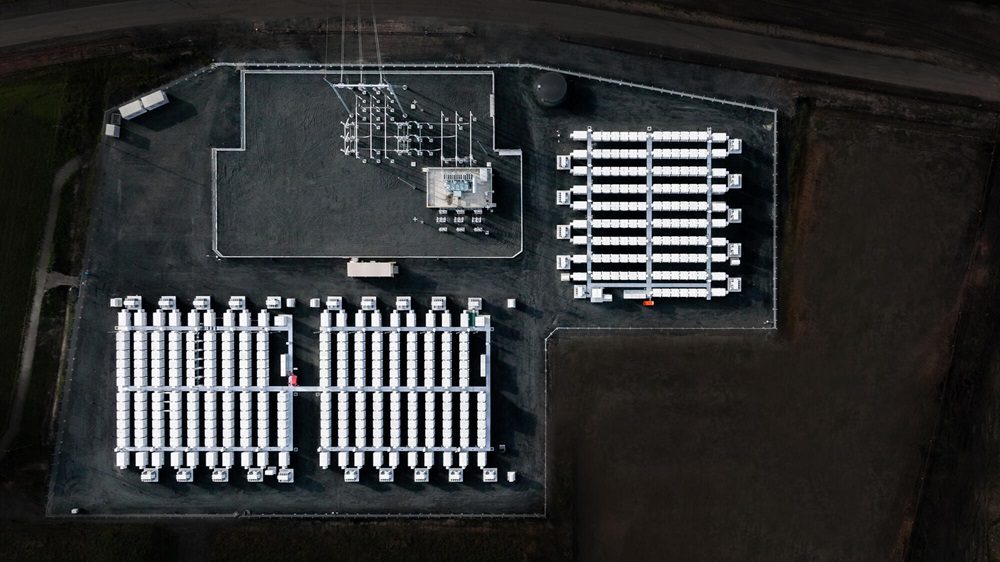

What is the purpose of a Battery Energy Storage System (BESS)? Mainly to balance a local power grid and ensure its stability in the face of any fluctuations it encounters. It is also an invaluable tool for optimizing the short-term volatility of energy markets.

In a context where renewable energies are increasingly being leveraged to supply power grids, the agility provided by BESS is proving to be an indispensable asset in compensating for the intermittency of solar or wind power: batteries capture excess energy during production peaks and release it during consumption peaks, ensuring the reliability of renewable energy systems.

Moreover, conventional energy installations (nuclear, thermal, hydroelectric power, etc.) can also be subject to hazards that temporarily degrade their performance. Here too, batteries play a stabilizing role, enhancing the resilience of energy networks. “Batteries are essential to help stabilizing the grid. Whenever a cloud passes by or the wind stops blowing, there will be a dip in renewable power production. Batteries can then react in a fraction of a second to inject power into the grid, before slower flexibility like demand side management or thermal power plants kick in. Likewise, whenever clouds disappear or wind picks up, batteries can instantly withdraw excess power from the grid,” confirms Brieuc Raskin, Vice President Revenues Europe Flexible & Renewable generation at ENGIE.

Why is it necessary to optimize Battery Energy Storage Systems?

Maximizing the efficiency of a system, a piece of equipment, or, more broadly, any asset has always been a legitimate and core objective for any industry. It has also become an absolute imperative regarding environmental responsibility anda strategic priority for the ENGIE Group.

In the particular case of BESS, optimization can focus on the physical capacity of the equipment itself, and on matching production to market needs.

Beginning with the initial investment, deploying a BESS involves a major financial commitment. That is why it is essential to calibrate the system to match the actual needs of the grid. As Brieuc Raskin explains: “When we assess battery investments, we look at both the ENGIE portfolio flexibility need as to the total market need for for flexibility. Battery revenues are strongly negatively correlated to the intermittency costs suffered by our native renewable and retail portfolios. By accurately sizing the battery in MW capacity and MWh storage, we can reduce the risk of tail events and stabilize the overall ENGIE revenue streams.

For example, where market prices tend to remain low for long periods due to the impact of high solar production, we prefer to invest in batteries with a long storage capacity, i.e. four to five hours or more. Elsewhere, in markets with very volatile imbalances markets, the benefits of batteries may lie more in short-term flexibility. In such cases, we don’t require long storage periods and we can use batteries with a storage capacity of just one or two hours.”

Throughout the battery’s lifecycle, it’s essential to optimize its use. We need to make sure that the battery will have the appropriate state of charge at any moment, to be able to inject or withdraw into the grid and capture the best price signals. Unlike heavy equipment like nuclear power plants, which adjust output more slowly, a battery can respond to market signals in milliseconds, enabling highly dynamic operations. Brieuc Raskin provides an example: “With a very small battery, you can generate more market transactions in an hour than a nuclear power plant could in ten years.” This entails that battery optimization is increasingly driven by algorithms, based on a multitude of weather or fundamental model-driven inputs which can be generated by AI. Sound regulation and market surveillance of the ensuing algorithmic-driven market transactions is therefore essential.

The promising future of BESS

COP28’s proposal to increase global renewable energy capacity to 11,000 GW by 2030 (compared with around 3,400 GW today) plots a very demanding course for the planet’s energy players. And the race against time is also on for BESS. As Hanne De Loof, Head of Portfolio synergies at ENGIE, explains, “In 2023, at ENGIE, our battery capacity was around 1GW. Today, we’re over 2 GW, and things are set to accelerate, with a goal of 10 GW by 2030. So the best is yet to come […] batteries enable us to reduce the risks associated with our assets and to supply green energy 24/7 to our customers.”

Battery Energy Storage Systems are not merely a complement to renewable energy but an essential pillar for achieving a low-carbon, resilient energy future.