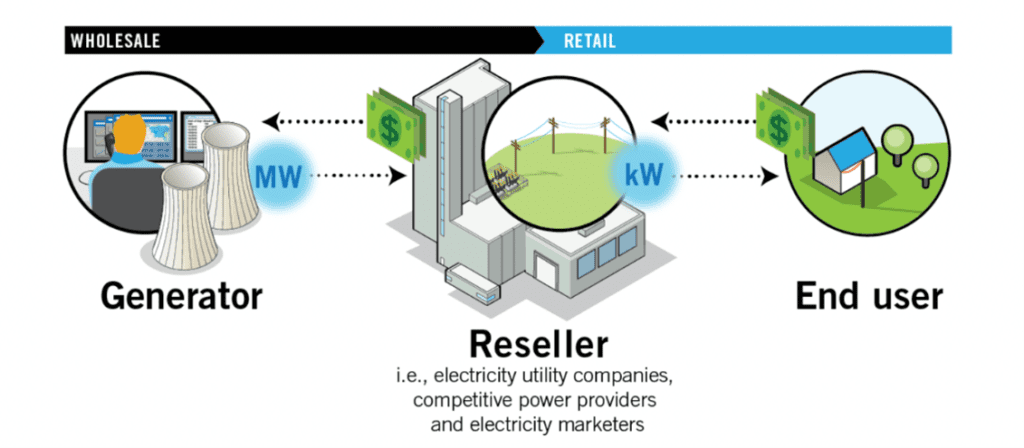

The wholesale energy market is a marketplace open for independent operators where electricity, natural gas, and other energy products are bought and sold in large volumes.

The energy is traded between generators, producers, who supply electricity or gas to the market, and suppliers or retailers, who purchase energy to supply to end consumers.

Besides trading, the wholesale market provides a transparent price refrence and solutions to manage energy in the short and long term.

But the energy market in the EU hasn’t always been as liberal as it is today. Before the 1990s, the wholesale energy market was regulated and controlled by the government.

The dynamics of the energy market

Energy market governed by the state

Before the 70s, the energy industry was typically heavily regulated and controlled by government entities. The prices for electricity and gas were often fixed by regulators and there was little competition among energy providers.

In many countries, the energy industry was dominated by a small number of large, vertically integrated utilities that controlled the entire energy supply chain, from generation to distribution. This meant that the end-user had little choice when it came to selecting their energy provider and prices were often set based on the cost of production, rather than market demand.

Liberalization of the energy market

In the 90s, the deregulation of the energy industry in many countries led to the emergence of competitive wholesale energy markets.

The purpose of the deregulation was to design a market with open infrastructure access, allowing buyers and sellers to trade electricity and gas at prices set up by the blance between supply and demand, thereby increasing efficiency, transparency and reducing costs.

The liberalization facilitated the energy market transition from coal to a broader range of energy sources. In the 2000s, the energy market experienced significant changes due to the rapid development of other energy commodities and renewable energy technologies, such as wind and solar power.

This further led to the introduction of renewable energy certificates and other mechanisms designed to incentivize the development and adoption of renewable energy sources.

A free wholesale energy market

Following the deregulation of the energy market and subsequent changes in the 90s, introducing a wholesale energy market composed of autonomous operators who manage and monitor its functioning in a coordinated manner.

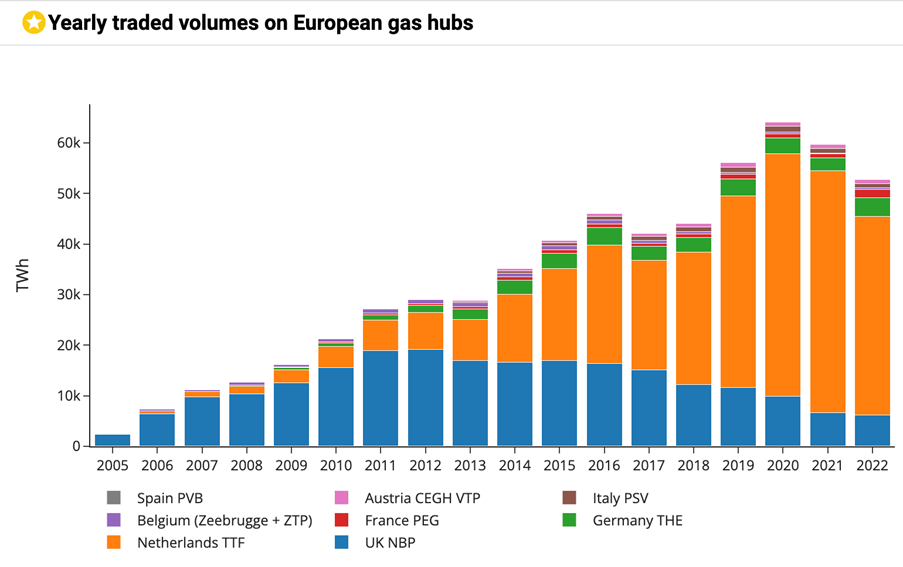

Wholesale markets are typically operated by a central market operator or exchange. Each country has its own national gas and electricity hub, which serves as a reference point for the domestic market. In addition, there are global and regional references for the wholesale energy market. In Europe, ICE and EEX exchanges serve as central trading centers for gas and electricity.

Source : https://learn.pjm.com/electricity-basics/market-for-electricity.aspx

Transfer Facility – European energy liquidity hub

The Title Transfer Facility (TTF) in the Netherlands is the most liquid gas hub in Europe. TTF serves as a benchmark for natural gas prices in Europe. TTF also plays a key role in the European gas infrastructure, as it is interconnected with other gas hubs and pipelines across the continent, facilitating the trading and transportation of natural gas.

EEX: Europe’s biggest electricity exchange market

European Energy Exchange (EEX) is a German energy market and a major player in the European electricity market.

EEX provides a transparent and secure trading platform for electricity, with many market participants including power producers, utilities, traders, and financial institutions. The company offers a range of contracts and products to manage price risks, such as day-ahead, intra-day, and forward contracts for electricity.

Unraveling wholesale energy market pricing

The wholesale energy prices are typically determined through complex supply and demand dynamics that are influenced by factors such as:

- The macroeconomic context,

- Geopolitical events,

- Weather patterns,

- Cost of alternative energy sources,

- Technological advancements,

- Government regulations.

The current geopolitical situation, for example, can have a significant impact on energy and electricity prices. In Europe and around the world, natural gas supply disruptions limited access to energy and electricity in 2022, particularly for low-income households and small businesses.

On the other hand, limited energy access and price volatility could lead to an increased focus on energy security and diversification. This could encourage the development of domestic renewable energy industries.

How is the wholesale energy market traded?

Traditionally, energy has been primarily traded Over The Counter (OTC), where participants trade bilaterally energy products without the need for an exchange. OTC trading usually takes place through a broker, with terms and prices negotiated on a bilateral basis.

However, there has been a noticeable shift towards exchange platforms for wholesale energy trading. This transition from OTC to exchange-based trading has been driven by the desire for greater transparency, liquidity, and market efficiency, as well as the need for improved risk management and regulatory oversight.

Keep on top of the energy market with EnergyScan

Stay informed about the latest trends in the wholesale energy market with ENGIE’s EnergyScan!

EnergyScan is a comprehensive tool designed for energy asset managers, traders, top executives, energy purchasers, analysts, and consultants. It provides valuable insights and economic research to help you stay ahead in the dynamic world of energy markets.

Request a demo today to discover how EnergyScan can simplify your access to critical information and empower you to make informed decisions in the wholesale energy market.